Zelda: Tears of the Kingdom shipped 10m copies in a weekend. Hogwarts Legacy sold 24m units in a year. Palworld is on 25 million players. Spider-Man 2 was Sony’s fastest-selling game. Starfield broke Bethesda records. And then there’s been Diablo 4, Super Mario Bros Wonder, Baldur’s Gate 3, Star Wars Jedi: Survivor, Resident Evil 4… sales records have been broken consistently over the past 12 months.

But then there have been those other headlines. You’ve seen them, too. 860 layoffs at Epic. 1800 redundancies at Unity. 1900 by Xbox. 900 by PlayStation. 530 at Riot. Nearly 700 at EA. I would give a running total of how many people have publicly lost their jobs in games over the last year, but the likelihood is that by the time this article comes out, the number will have gone up.

What the hell is going on? The answer has multiple facets to it, and to fully explain I need to take you back to 2019 BC (Before-Covid).

Newscast: Why are there so many games industry layoffs?

Newscast: Why are there so many games industry layoffs?

The pandemic boom

In 2019, the video games industry was strong and growing. PlayStation 4 and Xbox One sales were starting to fall, as were console game sales, but that was because we were approaching the end of the console cycle. It was all very normal. And declines in the console space were easily being made up by mobile games. According to data firm Sensor Tower, the global mobile games market grew 13% in 2019.

All of this attracted investors into games, who spent money hoping to find the next big hit. But then 2020 happened, and video games exploded.

Due to lockdowns, PC and console game sales grew by as much as 50 percent in certain territories, per data from chart numbers firm GSD. Mobile games revenue grew 26 percent worldwide, per Sensor Tower. In 2021, PC and console sales fell a bit – although only a bit, and partially impacted by PS5 stock shortages. But mobile gaming grew again, this time by over seven percent.

In other words, the games industry was making a lot of money. And it started to spend it – prompting three things to happen in excess. First, games companies began staffing up. They were adding new teams, commissioning more games, and even forming new studios.

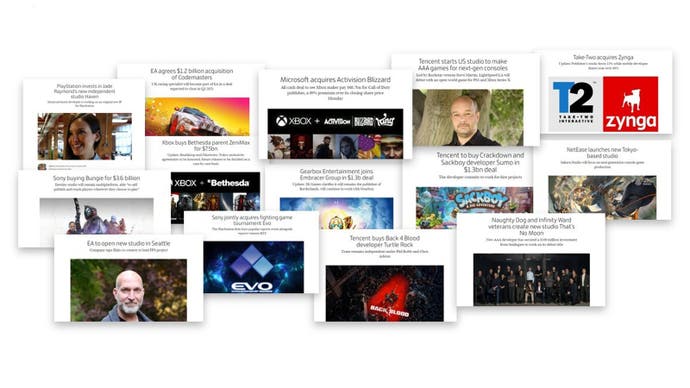

Then there were the acquisitions. Microsoft’s almost $70bn acquisition of Activision Blizzard (which only completed last year, but was announced in January 2022) was the headline act, but there were billion-dollar acquisition deals for the likes of Sumo Digital, Zynga, Bungie, Bethesda, Gearbox… there was even a fight between EA and Take-Two over who got to own Codemasters (EA won with a $1.2bn bid).

Lastly, games companies expanded significantly, while seasoned video game makers quit their jobs to form new AAA studios. The growth in games meant investors were excitedly part-funding new studios, and barely a week went by without GamesIndustry.biz reporting that a new studio had been set-up by a former Activision/EA/Riot/Blizzard/Ubisoft games veteran.

But there was one big challenge through all this – not enough experienced people to make all these games. Developers were struggling to find senior producers, creative directors, art directors, technical directors and so on.

And as a result, there was a war for talent. Games companies offered better wages and more benefits to attract people to them over their competitors. And with remote working now the norm, it was easier than ever for people to just leave one company and join the next… you just sent back your old company computer and received a new one.

The post-Covid hangover

The talent challenge aside, it was party time for video games. But then the music stopped. The games industry knew that when the lockdowns ended, people would start going back outside and revenue might fall. That was understood. And it’s worth noting that video game sales in 2023 are still bigger than they were in 2019, per GSD.

But what hadn’t been anticipated was Russia invading Ukraine, and the impact that had on inflation, cost-of-living and cost-of-business.

The rising cost-of-living would naturally impact people buying games. But cost-of-business is a particular challenge in video games. Games companies had already increased wages and expanded their teams, and now they needed to raise salaries again due to inflation, plus deal with increased travel costs, service fees, rent and so on.

Increasing the price of games to compensate isn’t an option, with most publishers having only just raised the price of their AAA games to $70/£70 in 2020 and 2021. Games execs told GamesIndustry.biz that they don’t think players would tolerate a further price hike.

This meant the cost of making games was spiralling upwards even more than it was before. Spider-Man 2’s reported budget of $300m was three times that of 2018’s Spider-Man 1. Tekken creator Katsuhiro Harada revealed that Tekken 8’s development budget was two to three times bigger than 2017’s Tekken 7.

Put simply, developers were seeing game sales fall, while costs are increasing. And that was a real problem.

Video games at a crossroads

There are other challenges. All of that investment in games during 2020 and 2021 means we’re now seeing an abundance of titles coming to market. There were over 14,000 games published on Steam last year. Many of those are smaller hobbyist games, sure, but it highlights just how fierce the competition has become.

The console space isn’t growing. PlayStation expected that once PS5 was in full supply, it could deliver 25m console sales in its financial year. Now, it thinks it will sell 21m, and PS5 is trending behind PS4. Xbox Series X/S are also struggling, with console sales down in 2023 vs 2022.

If you look purely at Xbox and PlayStation’s combined install base, the two platforms haven’t really grown in over two decades (around the 170 million to 180 million user mark). New players have come in, but almost as many have ‘aged out’ of consoles. Microsoft and Sony have grown revenue through things like DLC, microtransactions and subscriptions, but there comes a point where they need more customers, and so it’s no surprise to see them push their games onto PC (and in Xbox’s case now, other consoles).

Nintendo Switch remains a solid performer, but as it approaches its eighth year on the market, sales are understandably (and noticeably) slowing down. Meanwhile, the mobile games space has hit challenges after a decade of near-constant growth. Things have now hit a plateau, partly due to privacy changes which makes it harder for game developers to target users through advertising.

Lastly, there’s the situation with live-service games. Games companies are not just competing for money, they’re also competing for time. And gamers are spending hundreds of hours in games like Fortnite, Roblox and Call of Duty. It’s one thing to convince players to put these down to play a quick story-driven game, but it’s quite the other if you’re trying to make an online multiplayer game of your own. Players have all their progress in these games, and their friends are playing them, and although we do occasionally see a new online game break through, it’s rare they hang around for long. The top-performing live service games every year tend to be the same.

The great correction

As a video game company exec might say, business is facing severe headwinds. Sales are falling, costs are rising, the market isn’t growing fast enough, and there is too much competition. All of this means developers and publishers are looking at what they’re doing, focusing on the areas that are good at and cutting projects. That’s what has led us to these mass layoffs. It’s a situation that has been dubbed a ‘correction’.

The layoffs will slow down. Most of the big companies have made their moves now, and hopefully they won’t need to go further (some analysts speaking to GamesIndustry.biz believe companies may now need to hire back up within a few years). But the pain isn’t over.

This level of uncertainty has spooked investors. And with inflation as high as it is, some investors will feel it’s safer to put their money in the bank and earn 5% on it, rather than take a risk on a game or studio. Meanwhile, publishers are being more selective on the games they sign due to the competitive market. That leaves all those new developers we talked about earlier, reliant on investment to fund their projects, struggling to find that money.

Some of these developers are moving into work-for-hire development to bring in cash in the short-term… but with fewer games being developed overall, the competition in the work-for-hire space is also fierce. The reality is that a lot of these new teams will simply not be here next year, and the investment situation isn’t expected to get better until the end of 2024 at the earliest.

With so many people out of work, and so few jobs out there, you might expect to see new studios form. We will get a few, but with investors being increasingly conservative, the reality is that a lot of these artists, programmers, designers, producers, writers, and others will have to leave the games business to find work. I’m writing this article from a cold business point-of-view, but there’s no denying the horrible human cost of this ‘correction’. The anger towards executives, shareholders, and capitalism in general, is more than understandable.

Holding out for a hero

Is there any hope? 2024 looks tough. Analysts had expected Grand Theft Auto 6 and Nintendo’s new console to arrive in 2024, but they’re now slated for 2025. It’s not clear what, if anything, will excite the games market this year.

Meanwhile, some of the industry’s recent investments haven’t delivered the results some had hoped for. VR has found an audience, but a small one. Subscriptions grew rapidly but then stopped, and we will see if Call of Duty (and Activision Blizzard’s library generally) can do anything about that.

Streaming is also a long way from being significant. The dream for streaming is that it will help publishers and developers find new players because there’s now no need to own an expensive console to play these big games. But the technology and the business model simply aren’t there yet.

However, video games remains a young industry still, and for all its successes, there are still generations upon generations that didn’t grow up with games. As time goes on, the games industry will naturally grow as the number of ‘video game natives’ increases.

Switch 2, when it finally arrives, should provide a short-term boost to the business. Epic’s investment in Fortnite as a place to play and discover new games is also interesting. It has around 100 million monthly users, making it a bigger platform than most games consoles, so could prove to be an opportunity for game developers. And then there’s AI. It’s a controversial topic, with significant ethical and legal conversations to be had. However, if concerns can be worked through, it could (in theory) help speed up and bring down the cost of development, particularly for smaller teams.

The video games industry faces its first major crisis in 40 years. It’s an unprecedented and brutal situation. But if there’s one thing that gives me hope, it’s the games themselves.

Over the last year, we’ve seen some astonishing video games come out. The quality of what developers are making has never been better. And gamers are buying them in their millions. Ask a gamer if the industry is in crisis, and they’ll no doubt look confused at the mere suggestion. The industry’s foundations are strong, and it will bounce back.

If you found this interesting and would like to keep up to date on what is going on with video games, do check out the free GamesIndustry.biz newsletter. It comes out every day and covers all the big developments in the games business worldwide.